behavioural biases finance investment lists

In short its an egotistical belief that. Information-processing biases include anchoring and adjustment mental accounting framing and availability.

7 Behavioural Biases Affecting Investor Returns Mymoneysage Blog

We firmly believe that a consistent combination of value growth and sentiment is the key to good.

. In the book by Pompian Michael M. In finance confirmation bias can lead investors to ignore evidence that indicates their strategies may lose money causing them to behave to overconfidently. Everybody has biasesWe make judgments about people opportunities government policies and of course the markets.

Essentially we are our own worst enemy when it comes to investing. Overconfidence and illusion of control Overconfidence Bias Overconfidence bias is a false and misleading assessment of our skills intellect or talent. Understanding and detecting biases is the first step in overcoming the effect of biases on financial decisions.

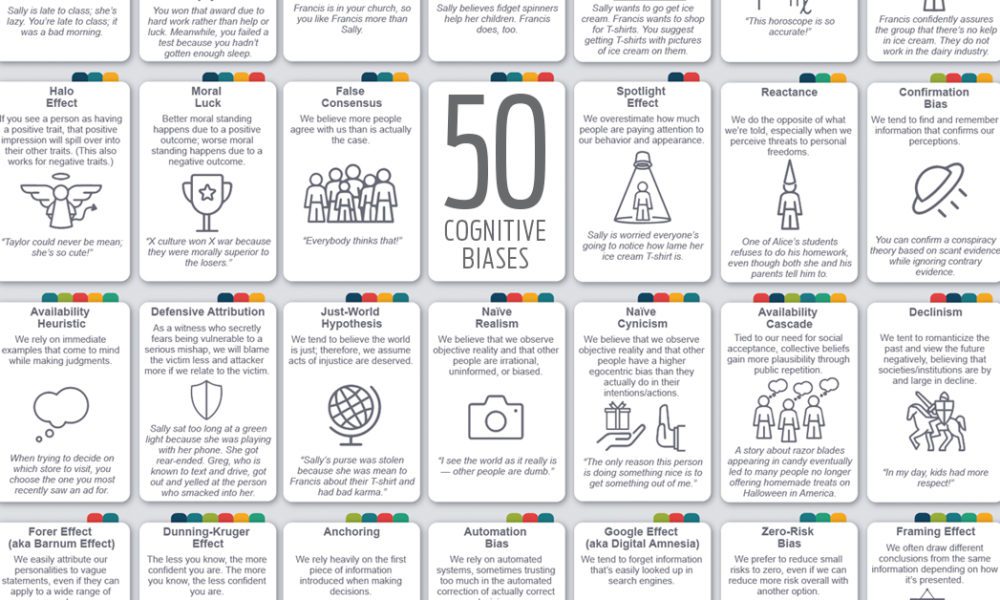

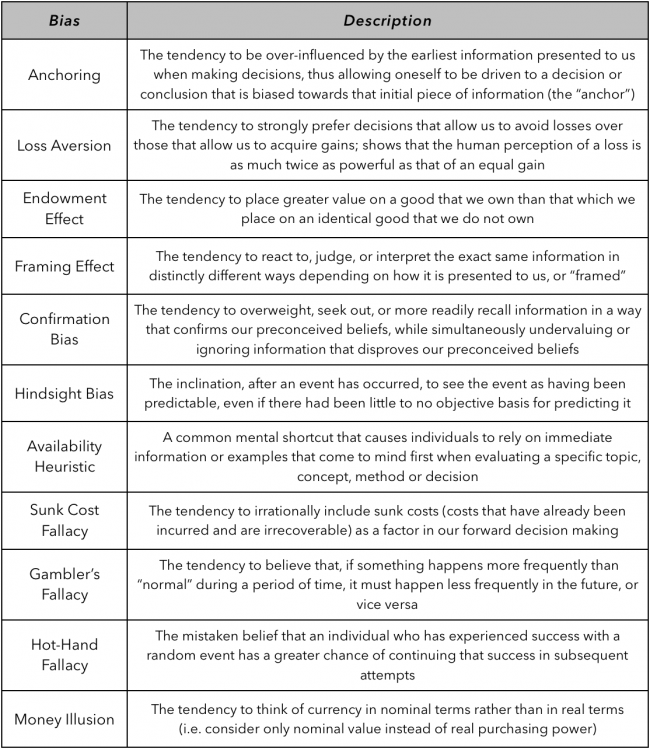

Here is a list of common financial biases. As an advisor its essential to be able to point out the various kinds of cognitive biases in behavioral finance and determine how to navigate your clients investor behavior accordingly. Behavioral finance proposes that the investment decision -making process is influenced by various behavioral biases that boost investors to deviate from rationality and take irrational investm ent.

We divide our money into different pots and then treat them all separately. Lets look at just a few of the most common biases in behavioral finance. Personal Finance Behavioural biases in home investment Sunday October 06 2019.

Home Behavioural Finance and Biases. 25 Hindsight Bias Hindsight bias refers to when past events appear to be more prominent than they actually were leading an individual to believe that said events were predictable even if there was no objective basis for. I find behavioural finance fascinating being interested in money and psychology.

Were unable to stop ourselves thinking we predicted events even though were woefully bad at predicting the future. Investors prefer to invest in their own local markets rather than seeking wider diversification. Top 10 Biases in Behavioral Finance.

We are more motivated to avoid loss than to acquire gain. These are biases a good behavioral investment manager is fully aware of and can take advantage of. Emotional biases include loss aversion overconfidence self-control status quo endowment and regret aversion.

Behavioral finance is a field of study that tries to identify and explain biases that cause people to make irrational investment decisions or behave in. In this article we will list down some of the behavioural motives behind real estate decision making. Behavioral finance seeks an understanding of the impact of personal biases on investors.

Pro athletes often say theyll trying not to lose more than theyre trying to win.

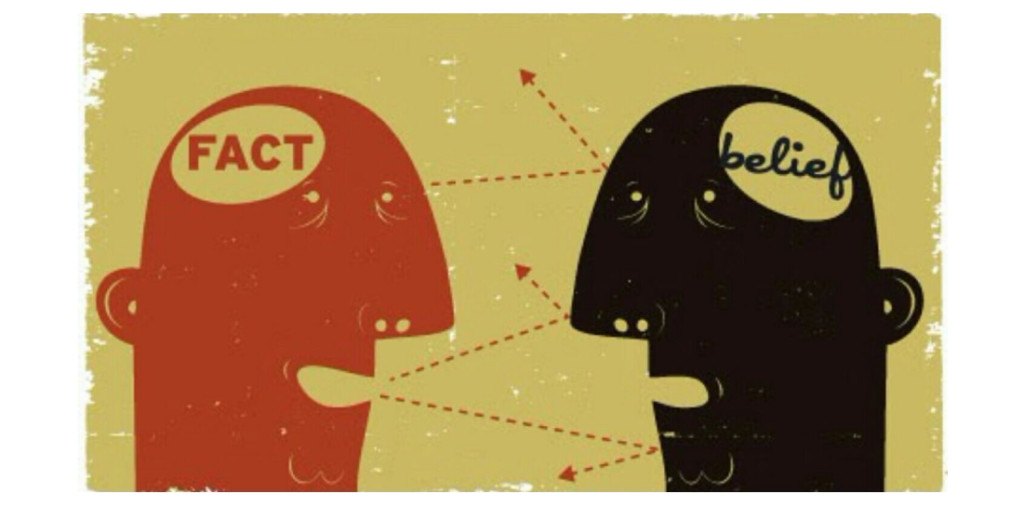

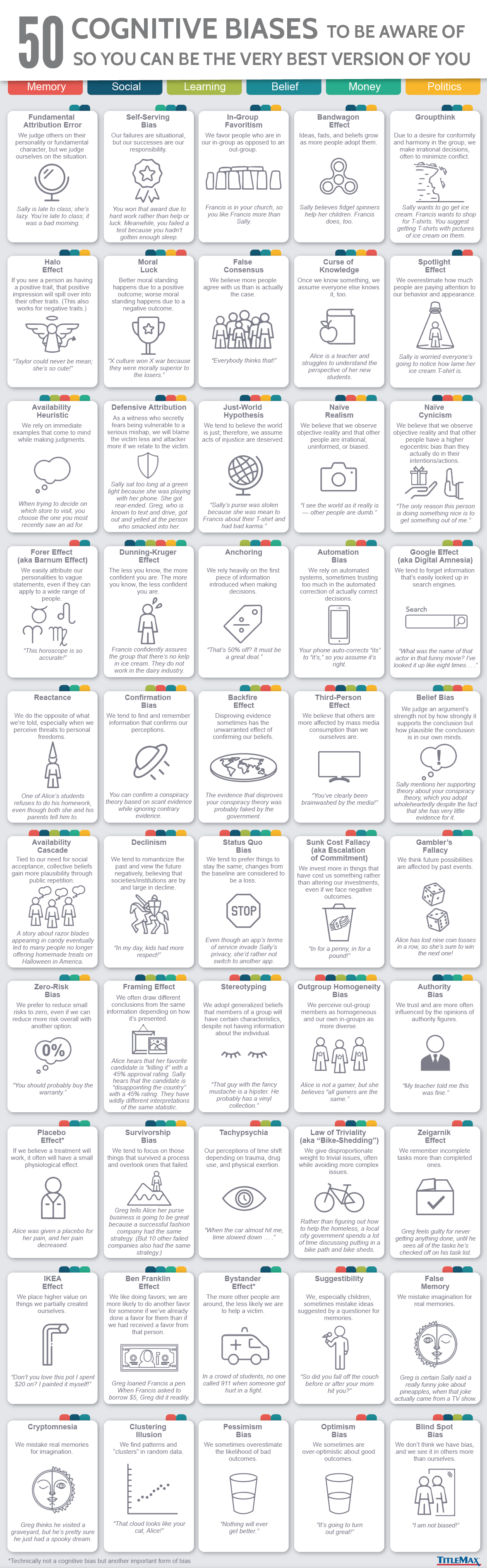

Infographic 50 Cognitive Biases In The Modern World

Infographic 50 Cognitive Biases In The Modern World

7 Behavioural Biases Affecting Investor Returns Mymoneysage Blog

/dotdash_INV_final-Modern-Portfolio-Theory-vs-Behavioral-Finance_Feb_2021-01-82cc44608fb94aa8b7f5946b7b502d57.jpg)

Modern Portfolio Theory Vs Behavioral Finance

How Behavioral Bias Impacts Investment Essentia Analytics

:max_bytes(150000):strip_icc()/dotdash_INV_final-Modern-Portfolio-Theory-vs-Behavioral-Finance_Feb_2021-01-82cc44608fb94aa8b7f5946b7b502d57.jpg)

0 Response to "behavioural biases finance investment lists"

Post a Comment